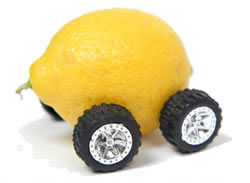

If product quality cannot be observed by buyers prior to purchase, then sellers will be tempted to skimp on it. Buyers then become reluctant to pay high prices as they learn to expect low-quality products — or “lemons.” The “lemons market” terminology is due to George Akerlof (1970), who explained how the pressure of competition may cause quality to deteriorate to such low levels that the market may fail to exist. This lemons outcome is discussed in some introductory and most intermediate microeconomics courses, and it is examined in some detail in a range of applied courses: industrial organization, regulation, antitrust, managerial economics, law and economics, game theory, and experimental economics.

Akerlof, Michael Spence, and Joseph Stiglitz jointly received the Nobel Memorial Prize in Economic Sciences in 2001 for their research related to asymmetric information. Akerlof’s paper uses the market for used cars as an example of the problem of quality uncertainty. It concludes that owners of good cars will not place their cars on the used car market. This is sometimes summarized as “the bad driving out the good” in the market.

Akerlof’s paper uses the market for used cars as an example of the problem of quality uncertainty. A used car is one in which ownership is transferred from one person to another, after a period of use by its first owner and its inevitable wear and tear. There are good used cars (“cherries”) and defective used cars (“lemons”), normally as a consequence of several not-always-traceable variables such as the owner’s driving style, quality and frequency of maintenance and accident history. Because many important mechanical parts and other elements are hidden from view and not easily accessible for inspection, the buyer of a car does not know beforehand whether it is a cherry or a lemon. So the buyer’s best guess for a given car is that the car is of average quality; accordingly, he/she will be willing to pay for it only the price of a car of known average quality. This means that the owner of a carefully maintained, never-abused, good used car will be unable to get a high enough price to make selling that car worthwhile.

Therefore, owners of good cars will not place their cars on the used car market. The withdrawal of good cars reduces the average quality of cars on the market, causing buyers to revise downward their expectations for any given car. This, in turn, motivates the owners of moderately good cars not to sell, and so on. The result is that a market in which there is asymmetric information with respect to quality shows characteristics similar to those described by Gresham’s Law: the bad drives out the good (although Gresham’s Law applies to a different situation).

“Lemon market” effects have also been noted in other markets, such as used computers . There are also parallels in the insurance market, where, unless those least likely to need insurance (i.e., those least likely to get in accidents) are forced to buy insurance, it is those most likely to need insurance compensation who tend most to buy insurance

By Zulfiqar Sheth. (Zulfiqar Sheth is an MA (Economics) Student at Aligarh Muslim University, India)